## Uncovering the Power of Monthly Budget Reviews

Are you ready to transform your financial habits and gain control of your spending? The secret weapon is simple: a monthly budget review. This powerful practice goes beyond basic budgeting, offering a holistic approach to understanding and improving your financial decisions. By diving into this process, you’ll uncover insights that can change the way you manage your money.

**Unleashing Financial Awareness:** The monthly budget review is like a personal financial audit. It’s a dedicated time to scrutinize your spending patterns, income sources, and savings. During this review, you’ll gain a detailed understanding of where your money goes and how it contributes to your overall financial health. This awareness is the first step towards making informed adjustments.

**Methodology for Success:** Start by gathering your financial records for the month, including bank statements, receipts, and expense tracking apps. Create two categories: ‘Essential Spending’ and ‘Discretionary Spending.’ Essential spending covers necessities like rent, utilities, and groceries, while discretionary spending includes entertainment, dining out, and impulse purchases. Analyze each expense, questioning its necessity and value.

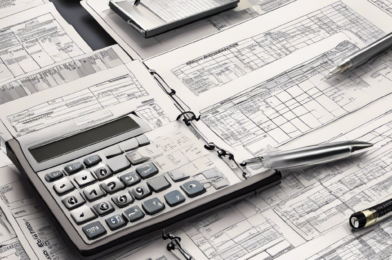

**Analyzing the Data:** As you review your spending, look for patterns and trends. Are there surprise expenses that could have been avoided? Are certain categories consistently exceeding your expectations? This analysis will help you identify areas for improvement. Perhaps you discover that your coffee shop visits add up significantly, or that your online shopping habit is costing more than you realized.

**Taking Action:** With insights in hand, it’s time to make strategic changes. Consider creating a plan to reduce discretionary spending by setting realistic goals and exploring alternative, cost-effective options. For instance, instead of daily coffee shop visits, you might invest in a quality coffee maker for your home or office.

In the journey towards financial wellness, the monthly budget review is a powerful ally. By allocating time for this process, you’ll gain a deeper understanding of your spending behaviors and discover opportunities to improve your financial situation. Embrace this practice, and watch as your financial well-being flourishes!